Search

Latest News

- Today’s news about Apple

- Today’s news about Microsoft

- Today’s news about Alphabet

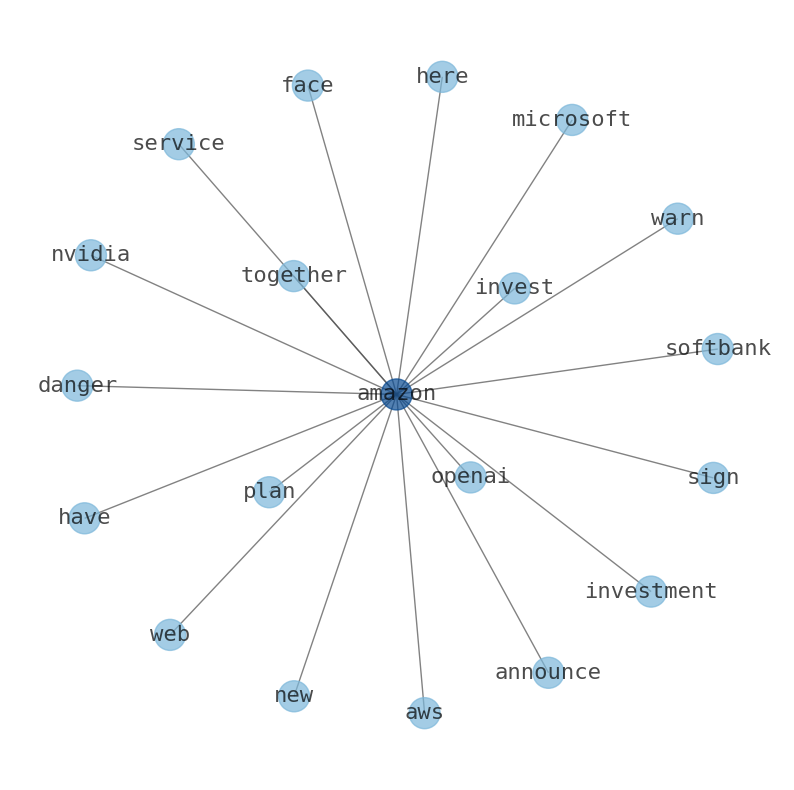

- Today’s news about Amazon

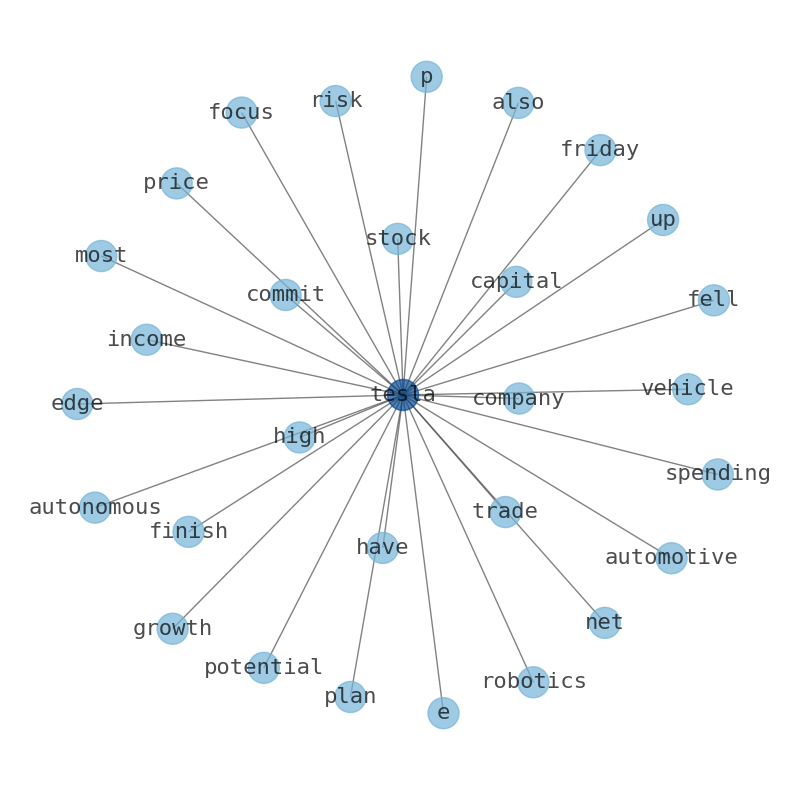

- Today’s news about Tesla

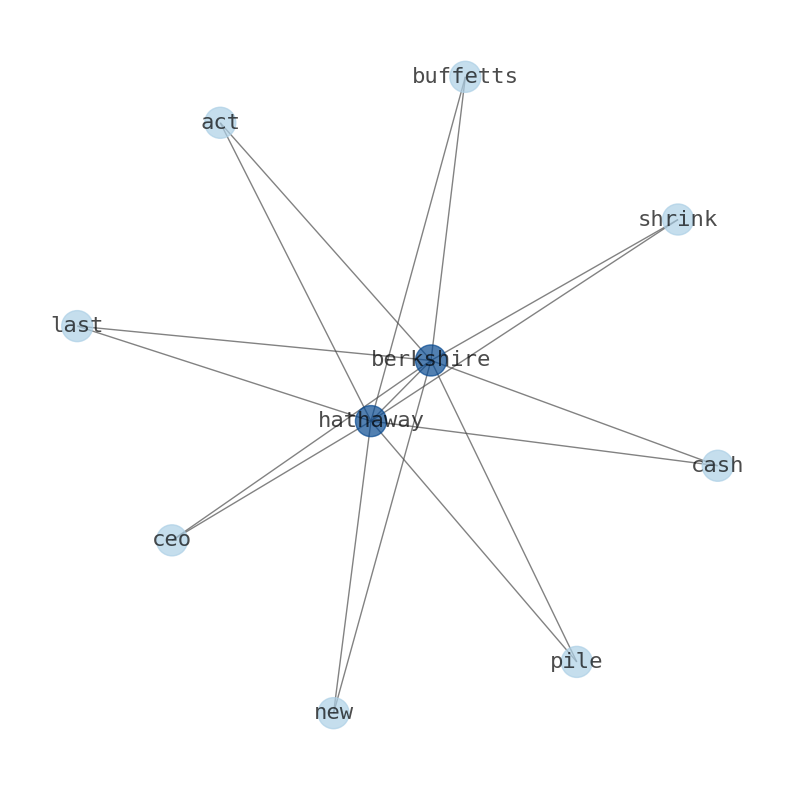

- Today’s news about Berkshire Hathaway

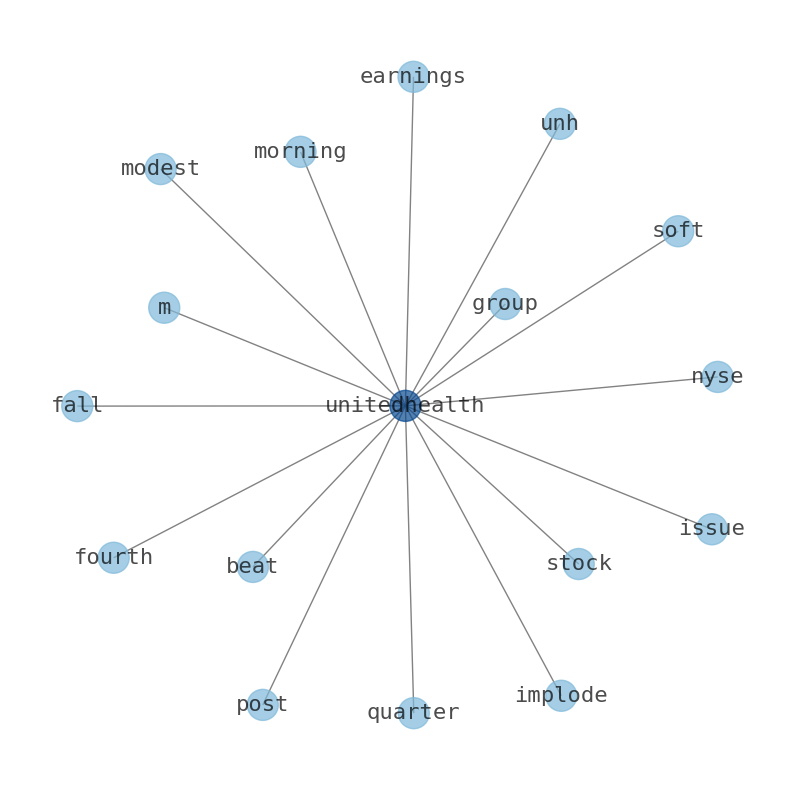

- Today’s news about UnitedHealth Group

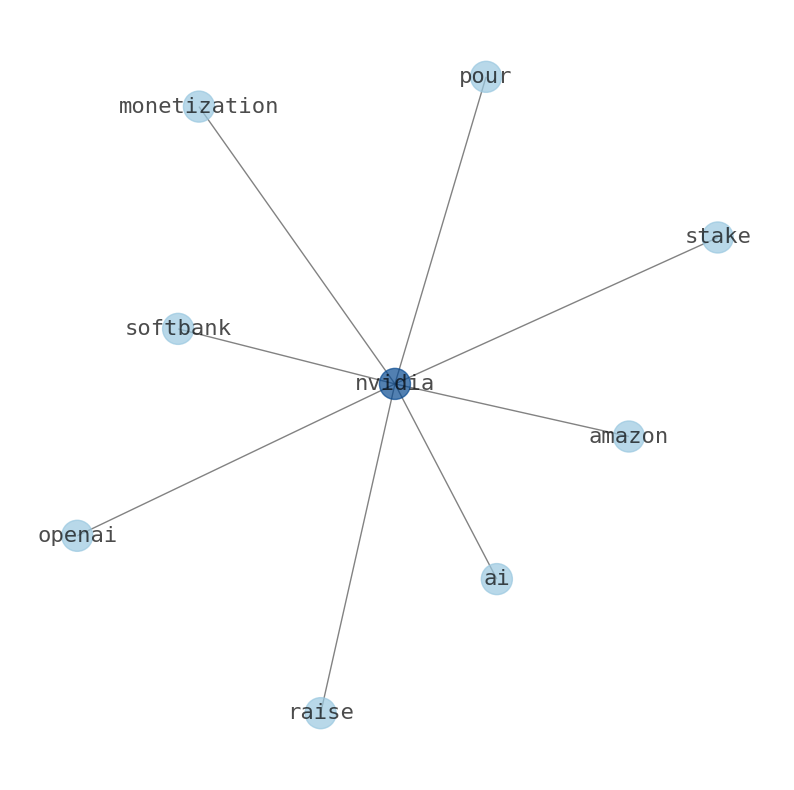

- Today’s news about NVIDIA

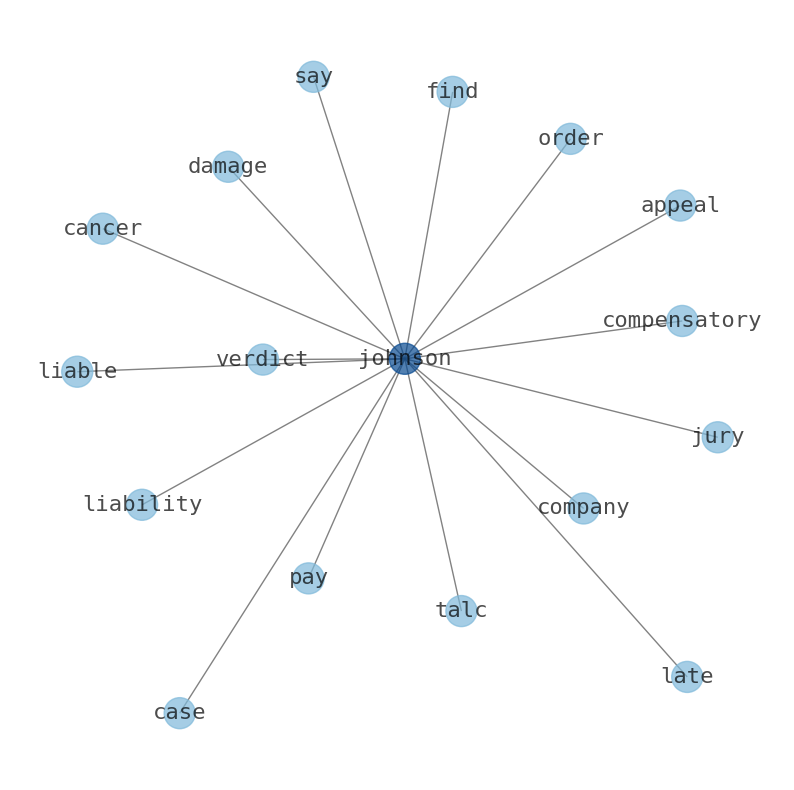

- Today’s news about Johnson & Johnson

- Today’s news about Taiwan Semiconductor Manufacturing Company

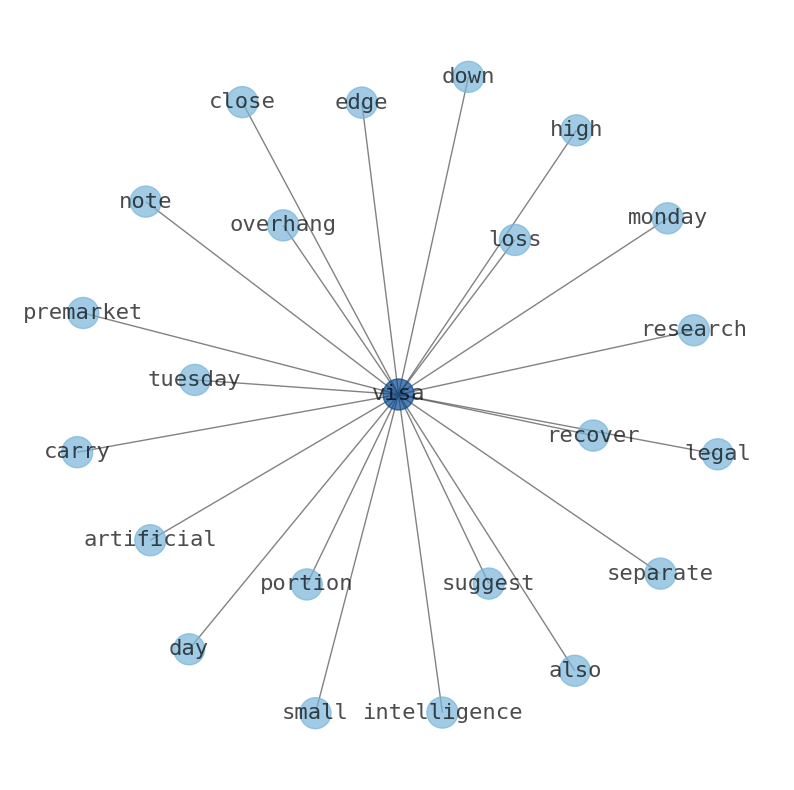

- Today’s news about Visa Inc.

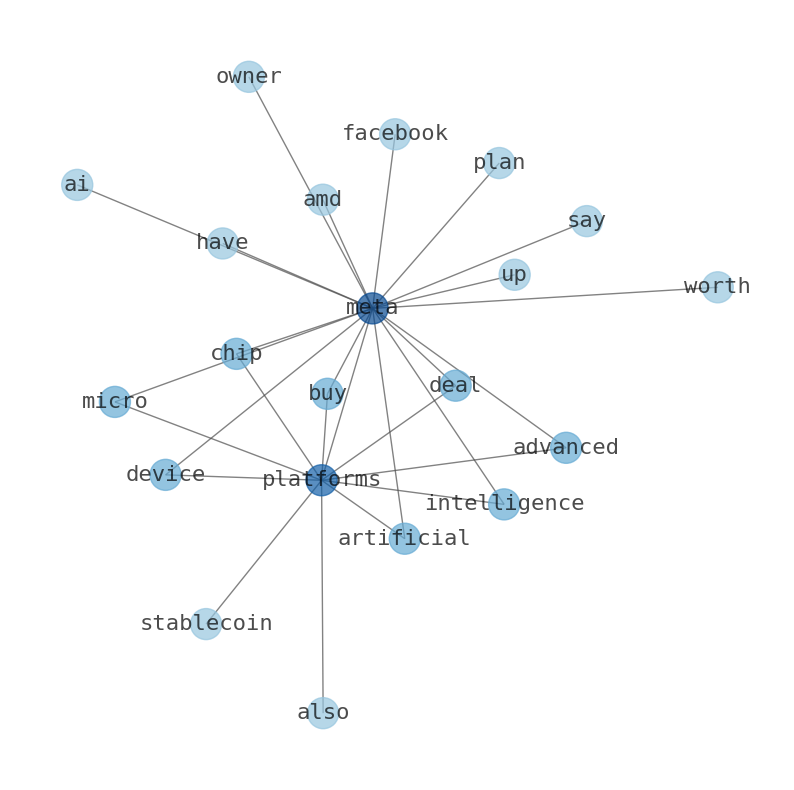

- Today’s news about Meta Platforms

- Today’s news about Exxon Mobil

- Today’s news about Walmart

- Today’s news about The Procter & Gamble Company

- Today’s news about Mastercard

- Today’s news about JPMorgan Chase & Co.

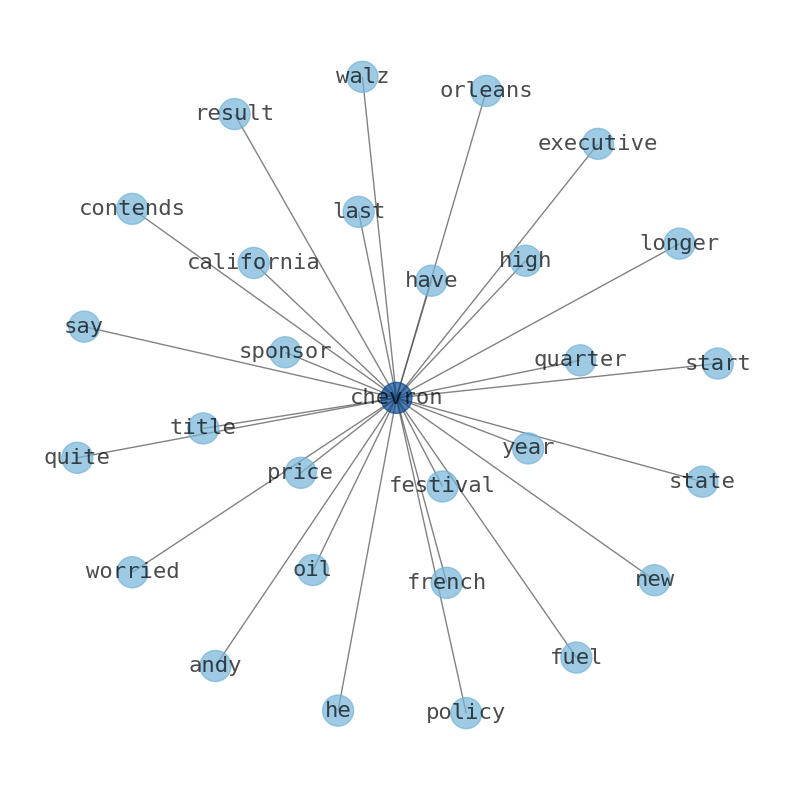

- Today’s news about Chevron

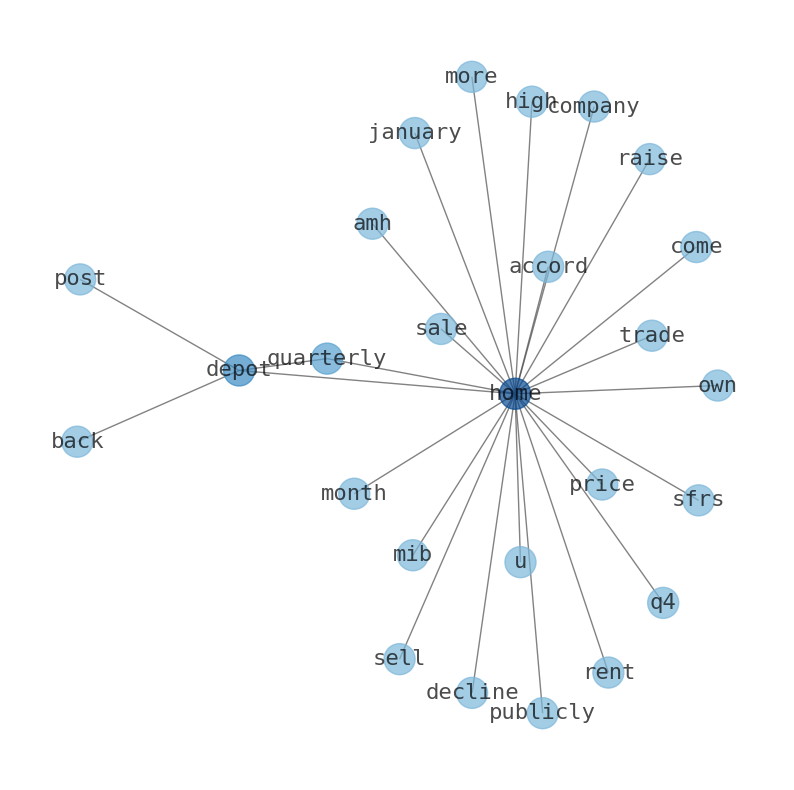

- Today’s news about The Home Depot

- Today’s news about Eli Lilly and Company

- Today’s news about Pfizer

- Today’s news about The Coca-Cola Company

- Today’s news about Bank of America

- Today’s news about Novo Nordisk

- Today’s news about Alibaba Group Holding

- Today’s news about AbbVie

- Today’s news about PepsiCo

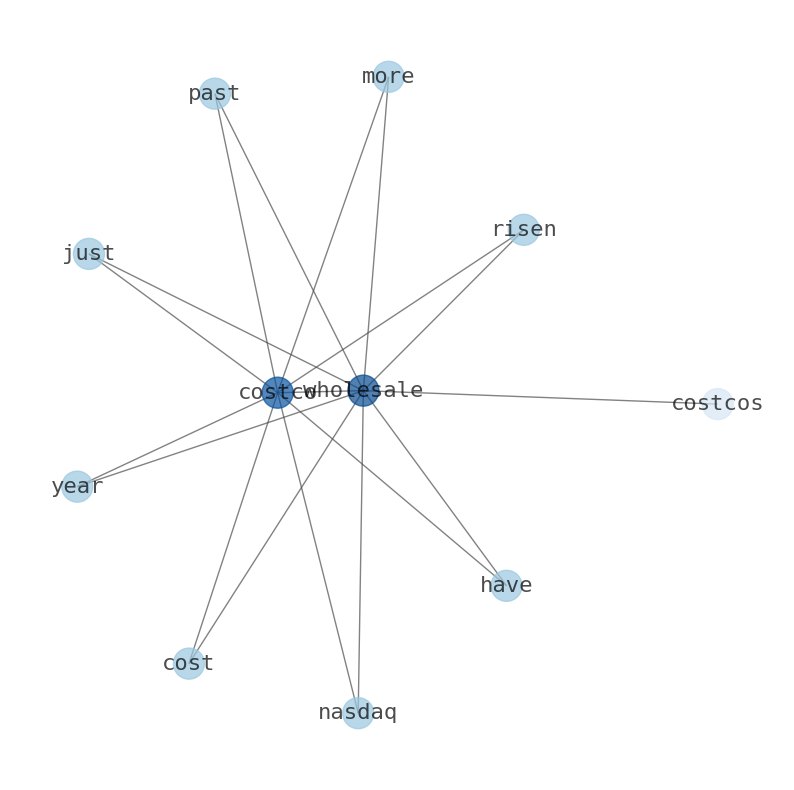

- Today’s news about Costco Wholesale

- Today’s news about Thermo Fisher Scientific

- Today’s news about ASML Holding

- Today’s news about Toyota Motor

- Today’s news about Merck & Co.

- Today’s news about Broadcom

- Today’s news about Danaher

- Today’s news about Oracle

- Today’s news about AstraZeneca

- Today’s news about McDonalds

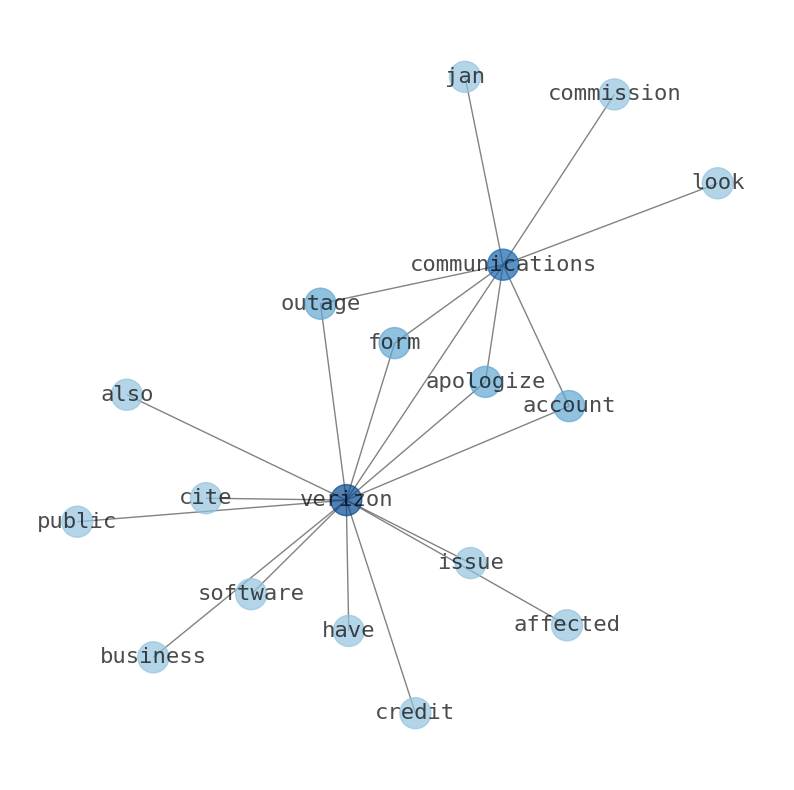

- Today’s news about Verizon Communications

- Today’s news about The Walt Disney Company

- Today’s news about Accenture

- Today’s news about Shell

- Today’s news about Adobe

- Today’s news about Abbott Laboratories

- Today’s news about BHP Group

- Today’s news about Cisco Systems

- Today’s news about Novartis AG

- Today’s news about Salesforce

- Today’s news about T-Mobile US

- Today’s news about Nike, Inc.

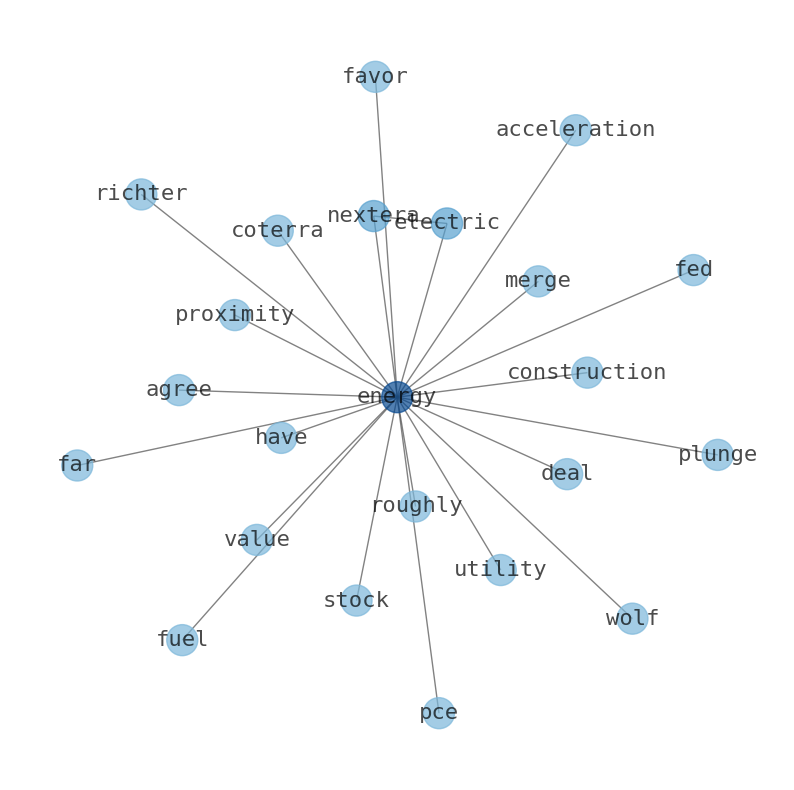

- Today’s news about NextEra Energy

- Today’s news about United Parcel Service

- Today’s news about Qualcomm

- Today’s news about Comcast

- Today’s news about Wells Fargo & Company

- Today’s news about Texas Instruments

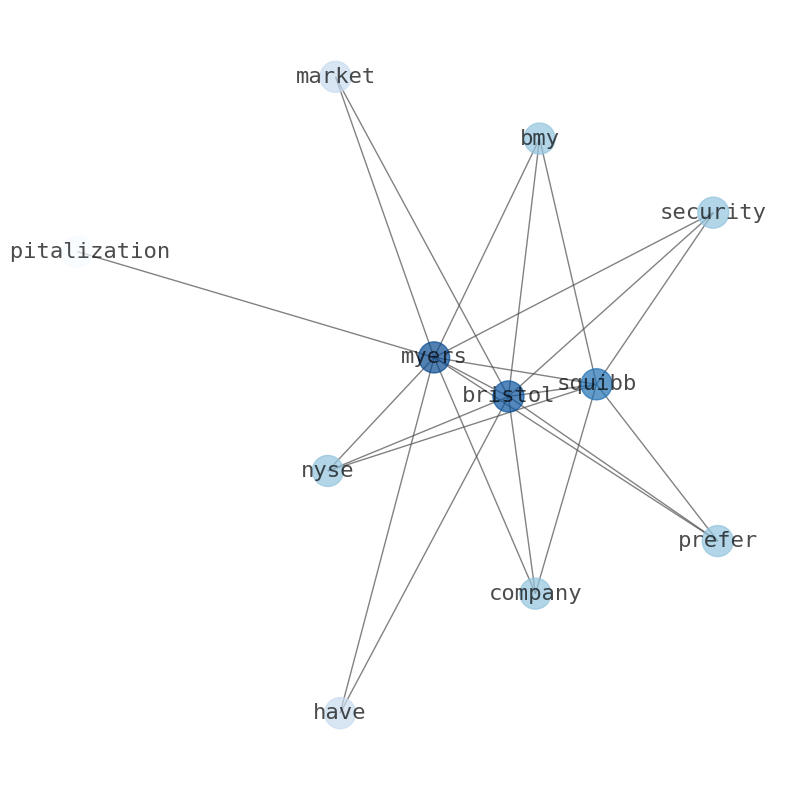

- Today’s news about Bristol-Myers Squibb Company

- Today’s news about Advanced Micro Devices

- Today’s news about Philip Morris International

- Today’s news about Intel

- Today’s news about Linde

- Today’s news about AMTD Digital

- Today’s news about Morgan Stanley

- Today’s news about Union Pacific

- Today’s news about Raytheon Technologies

- Today’s news about Royal Bank of Canada

- Today’s news about HSBC Holdings

- Today’s news about AT&T, Inc.

- Today’s news about Amgen

- Today’s news about TotalEnergies SE

- Today’s news about PetroChina Company

- Today’s news about Honeywell International

- Today’s news about The Charles Schwab Corporation

- Today’s news about S&P Global

- Today’s news about Intuit

- Today’s news about CVS Health

- Today’s news about American Tower

- Today’s news about Blackstone

- Today’s news about Unilever

- Today’s news about Lowes Companies

- Today’s news about Medtronic plc.

- Today’s news about ConocoPhillips

- Today’s news about Sanofi

- Today’s news about Equinor ASA

- Today’s news about International Business Machines

- Today’s news about HDFC Bank

- Today’s news about The Toronto-Dominion Bank

- Today’s news about American Express Company

- Today’s news about The Goldman Sachs Group

- Today’s news about Elevance Health

- Today’s news about Lockheed Martin

- Today’s news about SAP SE

- Today’s news about Diageo

- Today’s news about Sony Group

- Today’s news about Caterpillar

- Today’s news about Deere & Company

- Today’s news about PayPal Holdings

- Today’s news about BlackRock

- Today’s news about Netflix

- Today’s news about Citigroup

- Today’s news about The Boeing Company

- Today’s news about Automatic Data Processing

- Today’s news about The Estee Lauder Companies

- Today’s news about Rio Tinto

- Today’s news about Starbucks

- Today’s news about Prologis

- Today’s news about China Life Insurance Company

- Today’s news about British American Tobacco

- Today’s news about Applied Materials

- Today’s news about BP plc

- Today’s news about Petroleo Brasileiro

- Today’s news about JD

- Today’s news about Anheuser-Busch InBev

- Today’s news about ServiceNow

- Today’s news about Enbridge

- Today’s news about Analog Devices

- Today’s news about Mondelez International

- Today’s news about Cigna

- Today’s news about Canadian National Railway Company

- Today’s news about GSK plc

- Today’s news about Zoetis

- Today’s news about Duke Energy

- Today’s news about General Electric Company

- Today’s news about Infosys

- Today’s news about 3M Company

- Today’s news about Intuitive Surgical

- Today’s news about The Southern Company

- Today’s news about Brookfield Asset Management

- Today’s news about Marsh & McLennan Companies

- Today’s news about Stryker

- Today’s news about Altria Group

- Today’s news about Crown Castle International

- Today’s news about Booking Holdings

- Today’s news about Chubb

- Today’s news about Target

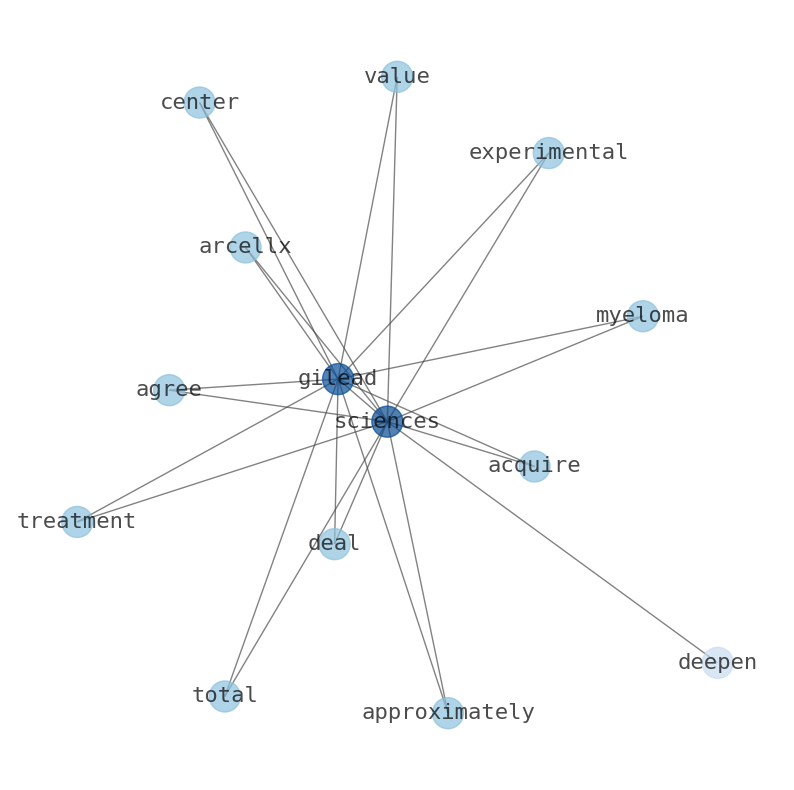

- Today’s news about Gilead Sciences

- Today’s news about Northrop Grumman

- Today’s news about The TJX Companies

- Today’s news about Canadian Pacific Railway

- Today’s news about The Bank of Nova Scotia

- Today’s news about ICICI Bank

- Today’s news about Charter Communications

- Today’s news about Mitsubishi UFJ Financial Group

- Today’s news about Fomento Economico Mexicano

- Today’s news about Airbnb

- Today’s news about U.S. Bancorp

- Today’s news about CME Group

- Today’s news about Vertex Pharmaceuticals

- Today’s news about CSX Corporation

- Today’s news about Becton, Dickinson and Company

- Today’s news about China Petroleum & Chemical

- Today’s news about Micron Technology

- Today’s news about Lam Research

- Today’s news about The PNC Financial Services Group

- Today’s news about Colgate-Palmolive Company

- Today’s news about Fiserv

- Today’s news about Waste Management

- Today’s news about Dominion Energy

- Today’s news about Truist Financial

- Today’s news about Bank of Montreal

- Today’s news about Illinois Tool Works

- Today’s news about The Progressive Corporation

- Today’s news about Moderna

- Today’s news about Regeneron Pharmaceuticals

- Today’s news about Equinix

- Today’s news about EOG Resources

- Today’s news about The Sherwin-Williams Company

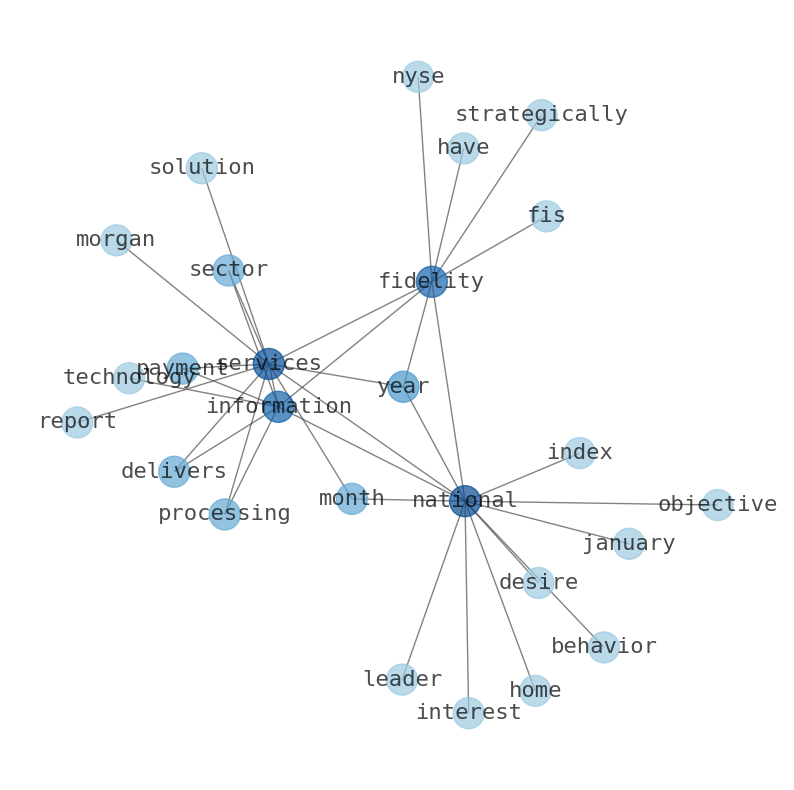

- Today’s news about Fidelity National Information Services

- Today’s news about Activision Blizzard

- Today’s news about Canadian Natural Resources

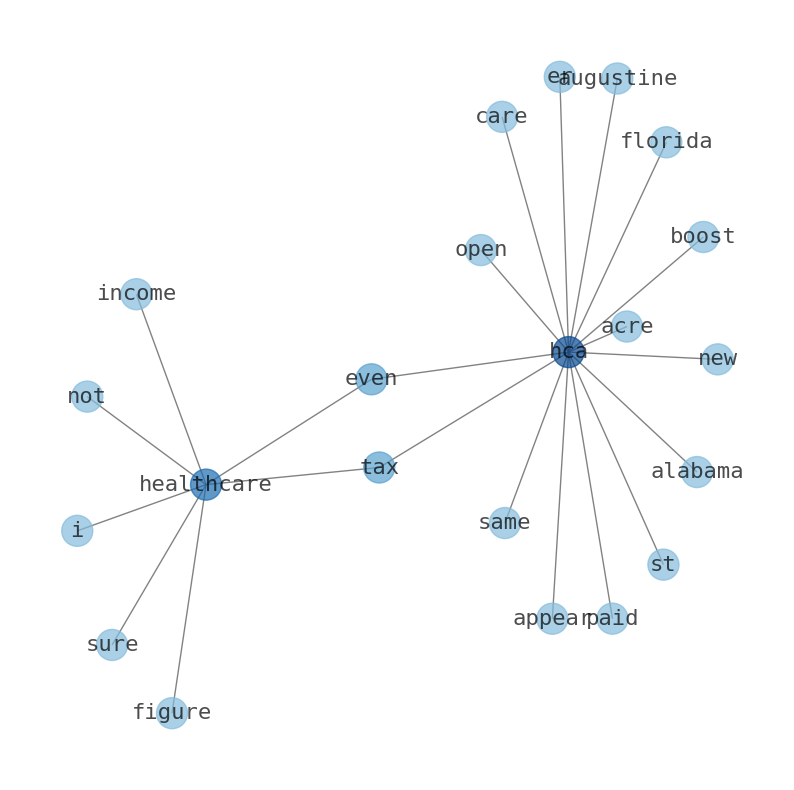

- Today’s news about HCA Healthcare

- Today’s news about General Dynamics

- Today’s news about Edwards Lifesciences

- Today’s news about FedEx

- Today’s news about Ford Motor Company

- Today’s news about Occidental Petroleum

- Today’s news about America Movil

- Today’s news about Pinduoduo

- Today’s news about NetEase

- Today’s news about Humana

- Today’s news about Aon plc

- Today’s news about Norfolk Southern

- Today’s news about Eaton

- Today’s news about Boston Scientific

- Today’s news about Enterprise Products Partners

- Today’s news about ABB Ltd

- Today’s news about Dollar General

- Today’s news about Public Storage

- Today’s news about UBS Group AG

- Today’s news about Relx PLC

- Today’s news about Synopsys

- Today’s news about Moodys

- Today’s news about Intercontinental Exchange

- Today’s news about Pioneer Natural Resources Company

- Today’s news about Keurig Dr Pepper

- Today’s news about KLA Corporation

- Today’s news about Air Products & Chemicals

- Today’s news about Thomson Reuters

- Today’s news about General Motors Company

- Today’s news about Centene

- Today’s news about Atlassian

- Today’s news about Emerson Electric Company

- Today’s news about Marriott International

- Today’s news about Monster Beverage

- Today’s news about Sempra Energy

- Today’s news about TC Energy

- Today’s news about Schlumberger

- Today’s news about MetLife

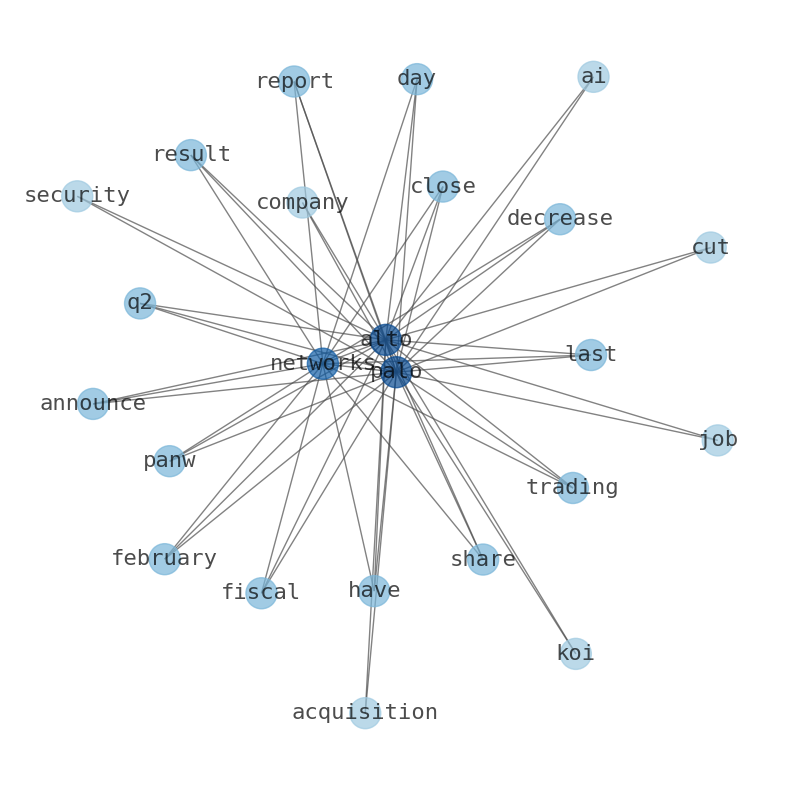

- Today’s news about Palo Alto Networks

- Today’s news about American Electric Power Company

- Today’s news about Cadence Design Systems

- Today’s news about National Grid

- Today’s news about McKesson

- Today’s news about VMware

- Today’s news about Marathon Petroleum

- Today’s news about NXP Semiconductors NV

- Today’s news about Uber Technologies

- Today’s news about Fortinet

- Today’s news about Snowflake

- Today’s news about Ecolab

- Today’s news about Autodesk

- Today’s news about Archer-Daniels-Midland Company

- Today’s news about The Hershey Company

- Today’s news about Marvell Technology

- Today’s news about Baidu

- Today’s news about L3Harris Technologies

- Today’s news about Constellation Brands

- Today’s news about Shopify

- Today’s news about Nutrien

- Today’s news about Suncor Energy

- Today’s news about The Kraft Heinz Company

- Today’s news about Stellantis

- Today’s news about Roper Technologies

- Today’s news about Kimberly-Clark

- Today’s news about Amphenol

- Today’s news about Paychex

- Today’s news about Canadian Imperial Bank of Commerce

- Today’s news about General Mills

- Today’s news about OReilly Automotive

- Today’s news about Exelon

- Today’s news about Block

- Today’s news about Honda Motor Company

- Today’s news about Ambev

- Today’s news about IQVIA Holdings

- Today’s news about Realty Income

- Today’s news about Takeda Pharmaceutical Company

- Today’s news about Itau Unibanco Holding

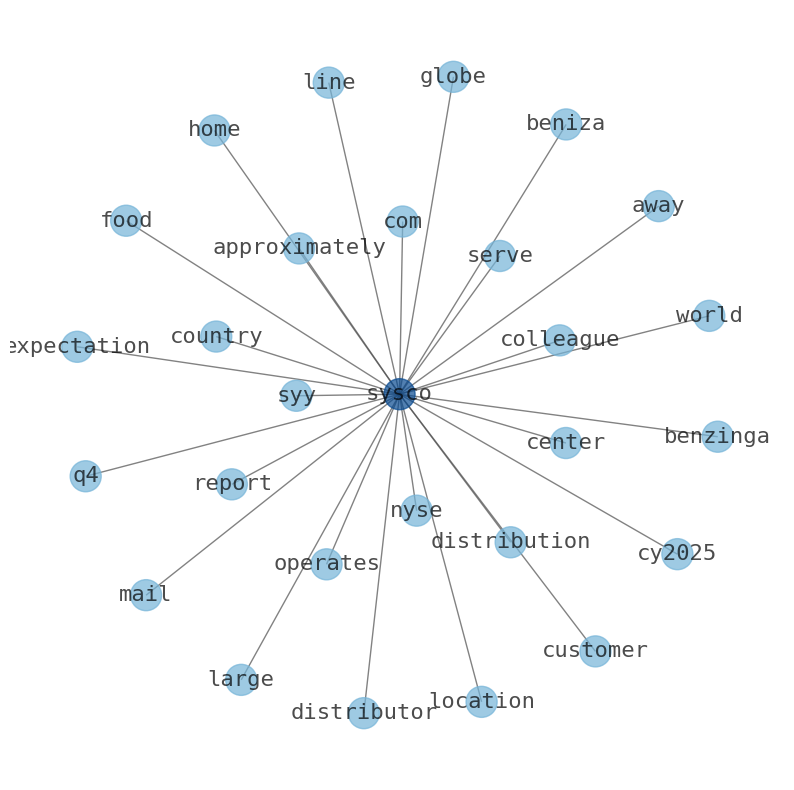

- Today’s news about Sysco

- Today’s news about Sumitomo Mitsui Financial Group

- Today’s news about Valero Energy

- Today’s news about Republic Services

- Today’s news about Sea Limited

- Today’s news about Chipotle Mexican Grill

- Today’s news about Woodside Energy Group

- Today’s news about Cintas

- Today’s news about Freeport-McMoRan

- Today’s news about Eni SpA

- Today’s news about CrowdStrike Holdings

- Today’s news about TE Connectivity

- Today’s news about AutoZone

- Today’s news about Capital One Financial

- Today’s news about Phillips 66

- Today’s news about The Williams Companies

- Today’s news about Vodafone Group

- Today’s news about Banco Santander

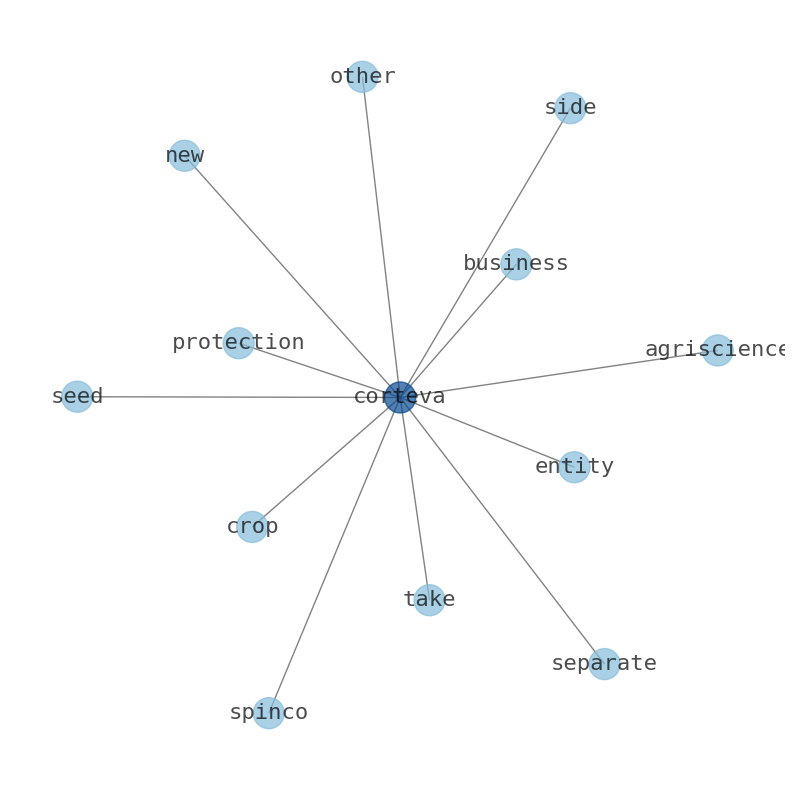

- Today’s news about Corteva

- Today’s news about MercadoLibre

- Today’s news about Simon Property Group

- Today’s news about Devon Energy

- Today’s news about Kinder Morgan

- Today’s news about American International Group

- Today’s news about Xcel Energy

- Today’s news about Banco Santander Brasil

- Today’s news about Agilent Technologies

- Today’s news about BioNTech SE

- Today’s news about Motorola Solutions

- Today’s news about Lululemon Athletica

- Today’s news about Workday

- Today’s news about Welltower

- Today’s news about Ferrari

- Today’s news about MSCI Inc.

- Today’s news about Alcon

- Today’s news about Microchip Technology

- Today’s news about Lloyds Banking Group

- Today’s news about Enphase Energy

- Today’s news about Digital Realty Trust

- Today’s news about Dow Inc.

- Today’s news about Johnson Controls International

- Today’s news about Dollar Tree

- Today’s news about Warner Bros. Discovery

- Today’s news about Prudential Financial

- Today’s news about Cheniere Energy

- Today’s news about The Travelers Companies

- Today’s news about Southern Copper

- Today’s news about Parker-Hannifin

- Today’s news about Electronic Arts

- Today’s news about Aflac

- Today’s news about Arthur J. Gallagher & Company

- Today’s news about Arista Networks

- Today’s news about ING Group

- Today’s news about Global Payments

- Today’s news about SBA Communications

- Today’s news about Cenovus Energy

- Today’s news about Newmont

- Today’s news about Brown-Forman

- Today’s news about Nucor

- Today’s news about Hilton Worldwide Holdings

- Today’s news about Banco Bradesco

- Today’s news about Cognizant Technology Solutions

- Today’s news about Yum! Brands

- Today’s news about ResMed

- Today’s news about Bank of New York Mellon

- Today’s news about Energy Transfer LP

- Today’s news about Consolidated Edison

- Today’s news about HP Inc.

- Today’s news about Manulife Financial

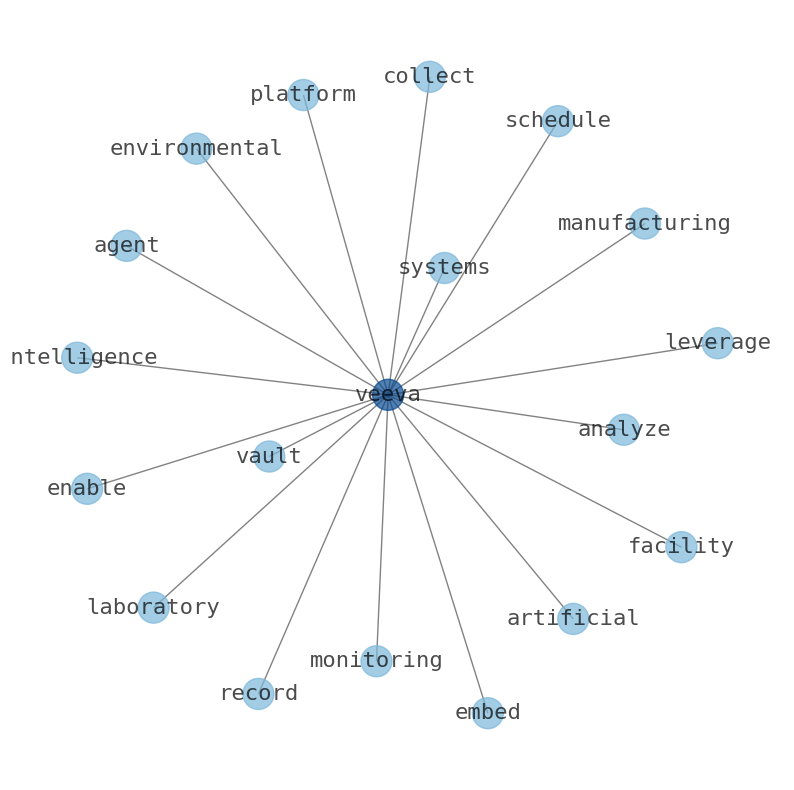

- Today’s news about Veeva Systems

- Today’s news about STMicroelectronics

- Today’s news about Walgreens Boots Alliance

- Today’s news about Old Dominion Freight Line

- Today’s news about TransDigm Group

- Today’s news about Apollo Global Management

- Today’s news about Trane Technologies

- Today’s news about Carrier Global

- Today’s news about Haleon

- Today’s news about Waste Connections

- Today’s news about Illumina

- Today’s news about Hess Corporation

- Today’s news about NIO Inc.

- Today’s news about Dell Technologies

- Today’s news about Dell Technologies

- Today’s news about IDEXX Laboratories

- Today’s news about Prudential

- Today’s news about The Kroger Company

- Today’s news about Otis Worldwide

- Today’s news about VICI Properties

- Today’s news about Li Auto

- Today’s news about DexCom

- Today’s news about NatWest Group

- Today’s news about Public Service Enterprise Group

- Today’s news about WEC Energy Group

- Today’s news about MPLX LP

- Today’s news about Barclays

- Today’s news about Datadog

- Today’s news about Seagen

- Today’s news about Coupang

- Today’s news about The Allstate Corporation

- Today’s news about International Flavors & Fragrances

- Today’s news about Tyson Foods

- Today’s news about TELUS

- Today’s news about Chunghwa Telecom Co.

- Today’s news about PACCAR

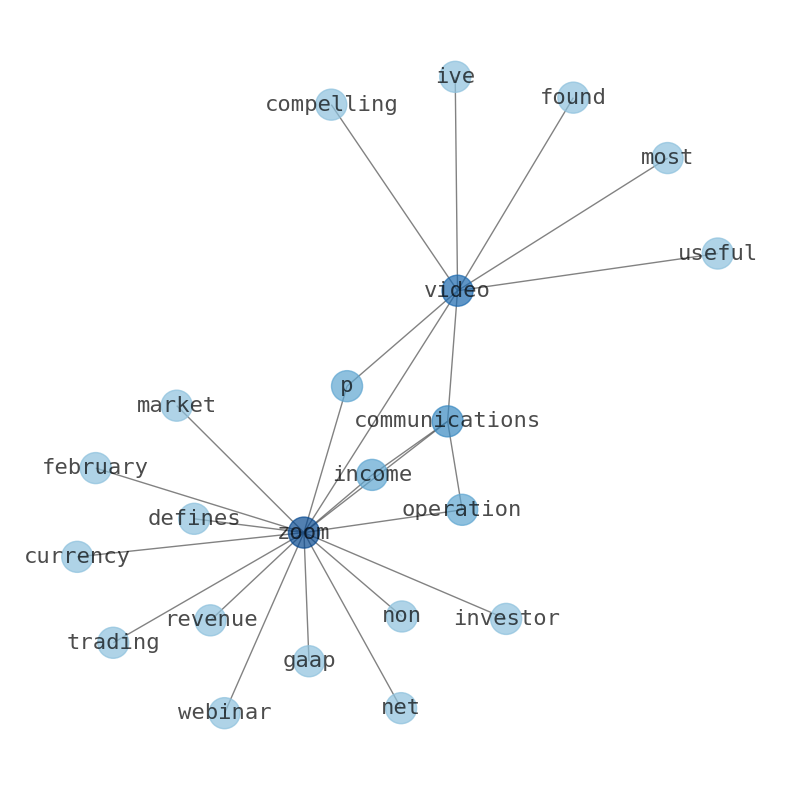

- Today’s news about Zoom Video Communications

- Today’s news about Twitter

- Today’s news about Mizuho Financial Group

- Today’s news about M&T Bank

- Today’s news about Eversource Energy

- Today’s news about Lucid Group

- Today’s news about Rivian Automotive

- Today’s news about Cummins

- Today’s news about Mettler-Toledo International

- Today’s news about Copart

- Today’s news about DuPont de Nemours

- Today’s news about AmerisourceBergen

- Today’s news about PPG Industries

- Today’s news about Biogen

- Today’s news about Imperial Oil

- Today’s news about Corning

- Today’s news about Verisk Analytics

- Today’s news about Equity Residential

- Today’s news about Fastenal Company

- Today’s news about Baxter International

- Today’s news about Nokia

- Today’s news about Nasdaq

- Today’s news about Keysight Technologies

- Today’s news about Wipro

- Today’s news about GlobalFoundries

- Today’s news about First Republic Bank

- Today’s news about Rockwell Automation

- Today’s news about AvalonBay Communities

- Today’s news about CRH Plc

- Today’s news about Ameriprise Financial

- Today’s news about Las Vegas Sands

- Today’s news about Aptiv

- Today’s news about Ross Stores

- Today’s news about Royalty Pharma

- Today’s news about Banco Bilbao Vizcaya Argentaria

- Today’s news about LyondellBasell Industries NV

- Today’s news about American Water Works Company

- Today’s news about Telkom Indonesia

- Today’s news about AMETEK

- Today’s news about CoStar Group

- Today’s news about Albemarle

- Today’s news about W.W. Grainger

- Today’s news about Sociedad Quimica y Minera de Chile

- Today’s news about Discover Financial Services

- Today’s news about Barrick Gold

- Today’s news about T. Rowe Price Group

- Today’s news about CBRE Group

- Today’s news about ON Semiconductor

- Today’s news about Weyerhaeuser Company

- Today’s news about eBay Inc.

- Today’s news about Orange

- Today’s news about Sun Life Financial

- Today’s news about Roblox

- Today’s news about Extra Space Storage

- Today’s news about Ferguson

- Today’s news about ONEOK

- Today’s news about Sirius XM Holdings